Decoded’s Take

- Marriott enjoys extraordinarily high margins — higher than that of most software companies.

- While most may think of Marriott as a hotel chain that sells travel to consumers, its real business is selling hotel franchisees its brands and the ability to participate in its Bonvoy loyalty program.

- The hotel loyalty business has strong barriers to entry and heavily favors scaled players like Marriott, protecting its revenues and margins from upstart competition.

The Business

Marriott primarily operates and franchises hotels. Its 30+ brands comprise of an impressive 8,462 hotels across 139 countries.

If you’re a frequent traveler, you would undoubtedly have heard of the Marriott Bonvoy loyalty program. Marriott awards members points when they stay at Marriott-branded hotels, and these points may be redeemed for stays at Marriott properties. When points are redeemed, Marriott reimburses the property for the free stay according to a reimbursement rate formula, which typically costs Bonvoy a lot less than cash rates charged to guests. Marriott also awards different status levels to members depending on number of nights stayed per year or amount of money spent per year, resulting in various benefits to elite members such as free breakfast, free room upgrades, late checkouts, lounge access, and more. The program is especially popular among business travelers, who are less price sensitive due to their ability to reimburse travel expenses with their employers.

Marriott’s 177M members contribute ~60% of total hotel room revenue and room bookings to Marriott properties. Further, these bookings are made directly via Marriott.com or Marriott phone lines, which are far more profitable channels than online travel agencies like Expedia that charge hefty commissions.

Bonvoy’s captive membership audience enables Marriott-branded properties to earn more revenue and profits than similar non-Marriott-branded properties.

Though you may think of Marriott has a “hotel chain,” the company owns only 19 properties and leases 32. Every other hotel operating one of its brands is either managed or franchised, comprising of 24% and 75%, respectively (data as of Q3 2023).

For managed properties, Marriott employs hotel staff and performs full-service property management for hotel owners. It charges a “base management fee” which is typically calculated as a percentage of gross rental revenue and an “incentive management fee,” which is typically calculated as a percentage of hotel profits (the higher the profits –> the better Marriott did as a property manager –> the more Marriott makes). Marriott is also reimbursed directly by the property for direct and indirect costs of operating the hotel. Because management contracts aren’t made public, specific take rates are unknown.

For franchised properties, Marriott provides to franchisees the use of one its brands and a set of systems, standards, and rules, but the responsibility of running the property day-to-day lies with its partner. Marriott charges 4-7% of the gross rental revenue for their franchise fee, 2-4% for revenue generated from loyalty program members to operate the loyalty program (and requires properties to provide benefits to elite members for free), plus another 1-3% for “program services,” including marketing. That’s roughly 7% – 14% of gross rental revenue taken right off the bat. In addition, Marriott charges 2-3% of food and beverage sales and another 20-odd pages of sales and marketing fees, technology fees, and operations fees.

Hotel owners tolerate Marriott’s onerous fees with the hopes of generating higher profits from the use of its brand and its large member base.

| Number | |

| Owned | 19 |

| Leased | 32 |

| Managed | 2,039 |

| Franchised | 6,372 |

| All Hotels | 8,462 |

Marriott separates its brands into three broad buckets: Luxury (eg Ritz Carlton, St Regis, W), Premium (eg Marriott, Sheraton, Westin), and Select (eg Courtyard, Residence Inn, Fairfield Inn, and Springhill Suites).

Understandably, the company is generally more protective of its Luxury and Premium brands and more lax with its Select brands. The Ritz and the W each have one franchise, the St Regis has none. Marriott, Sheraton, and Westin are all roughly 50% franchised. The Select properties are heavily franchised: Courtyard (77%), Residence Inn (91%), Fairfield Inn (94%), Springhill Suites (95%).

The Numbers

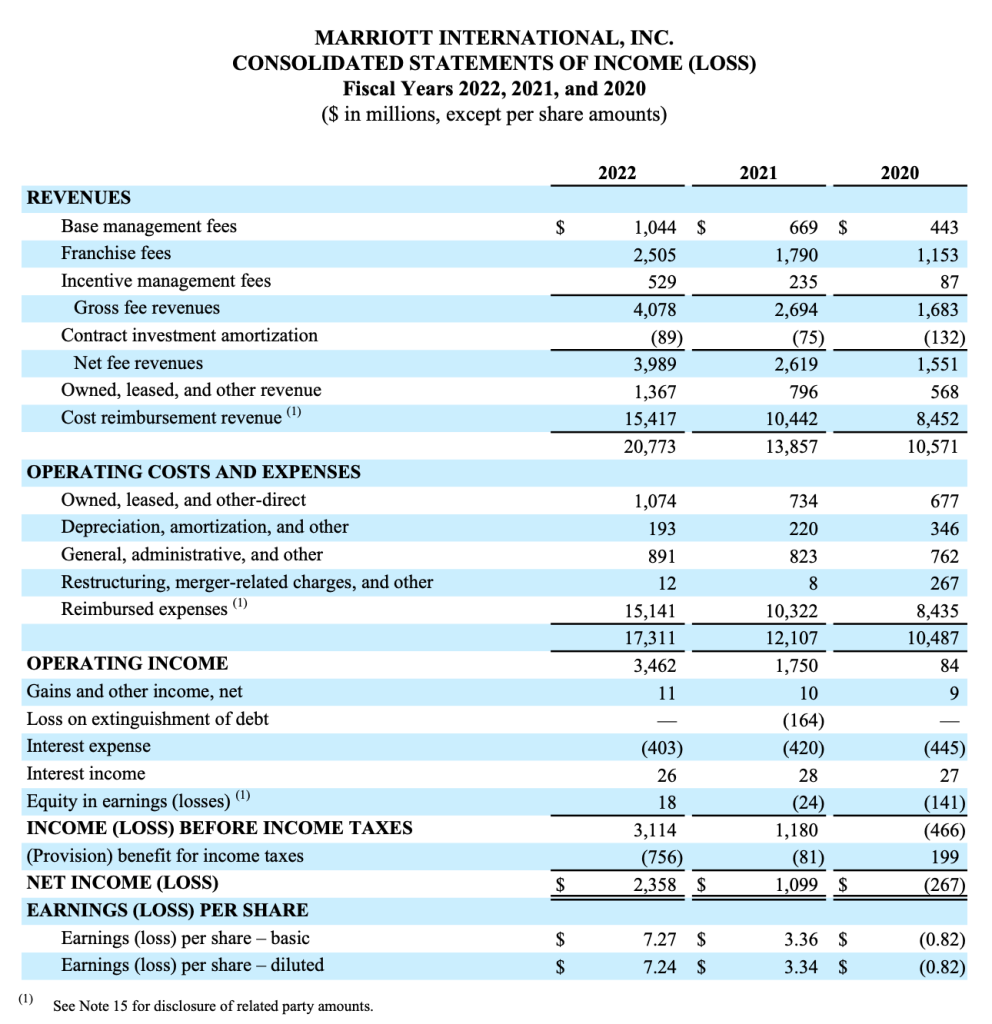

Marriott is a lean, mean, profit machine. In 2022, the company reported 44% net profit margins (disregarding cost reimbursements), while Microsoft reported 37%, JPM 31%, and LVMH 18%.

For the year ending in 2022, Marriott earned $1.0B in base management fees, $0.5B in incentive management fees, and $2.5B in franchise fees. It generated a net revenue of $0.3B on its owned and leased properties business (net of direct expenses) and a $0.3B in excess cost reimbursements (Remember that the managed and franchised properties pay for all direct expenses that Marriott incurs on behalf of the hotels. While cost reimbursements are not designed to make a profit or loss long-term, they will have short-term fluctuation).

For all that revenue, it only recognized general operating costs of $0.9B and depreciation & amortization cost of $0.2B, leading to an impressive $3.5B in operating profit.

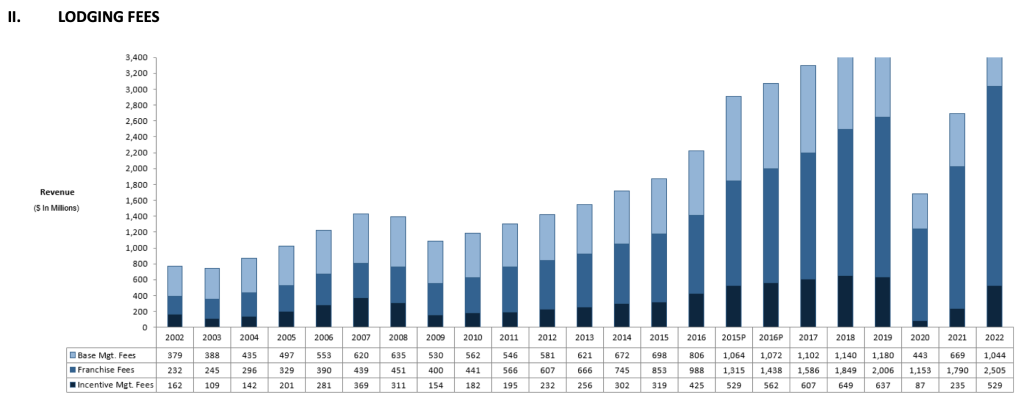

This incredible profitability is largely driven by its franchise dominant business model, which Marriott has been growing aggressively over the last 20 years. It grew franchise fees collected from $232M (30% of fee revenues) in 2002 to $2.5B (61% of fee revenues) in 2022.

Analysis

Marriott’s Bonvoy membership program is highly valuable to hotel owners — and highly resistant to upstart competition.

There are very few fundamental product differences between hotel brands and hotel loyalty programs. Hilton, IHG and others offer very similar value propositions to both travelers and hotel owners. The single most important factor that determines the competitiveness of a loyalty program? Scale.

Travelers want access to more hotel rooms in more locations with more variety. A larger and more diverse property portfolio will attract more loyal members, and more loyal members will attract more franchisees.

Marriott is the largest chain in the world, with more than 1.5M hotel rooms. It has an incredibly diverse set of brands in its portfolio, ranging from budget to ultra luxury to satisfy a traveler’s every need. Its top competitors include Hilton (1.1M rooms), Wyndham (843k), IHG (744k), Choice (570k), and Hyatt (304k). Unsurprisingly, the number of loyalty members for each chain follows its room count: Marriott (177M), Hilton (150M), Wyndham (103M), Choice (60M), and Hyatt (36M).

| Rooms | Members | |

| Marriott | 1,500,000 | 177,000,000 |

| Hilton | 1,100,000 | 150,000,000 |

| Wyndham | 843,000 | 103,000,000 |

| IHG | 744,000 | 100,000,000 |

| Choice | 570,000 | 60,000,000 |

| Hyatt | 304,000 | 36,000,000 |

Of course, Marriott’s continued dominance isn’t guaranteed. To keep its market leading position, Marriott needs to ensure that it continues to expand its footprint to bring in ever more properties, to innovate on its brand offerings to keep up with traveler shifting demands and tastes, to maintain consistent standards across its vast portfolio, and to preserve the attractiveness of its loyalty program.

One thing is certain. This industry is extremely unfriendly to upstarts. To build a new hotel franchise, you’d have to start by building, buying, or leasing hotels that you brand and operate. That requires a tremendous amount of capital and time. Once you establish your brand (likely after many years), you’d have to convince other hotel owners to either allow you to manage their property or franchise your brand. You’d have to convince them that your brand and systems will generate more profits than the ones offered by Marriott or one of its established competitors, which have much more direct traffic, much better deals with distributors, and much more brand recognition among consumers. Definitely not for the faint of heart.

Resources

Marriott Investor FactBook: https://marriott.gcs-web.com/investor-fact-book

Marriott Franchise Agreements: https://www.hotel-development.marriott.com/how-we-work-together/resources

Marriott Earnings Reports: https://marriott.gcs-web.com/financial-information/quarterly-results

Leave a Reply